Property tax bill examples

Property tax bills vary depending on the school district where you live. Below are samples of school tax bills from various parts of the state. Even if your bill is not identical to any of the samples, it will likely include similar fields.

Sample tax bills

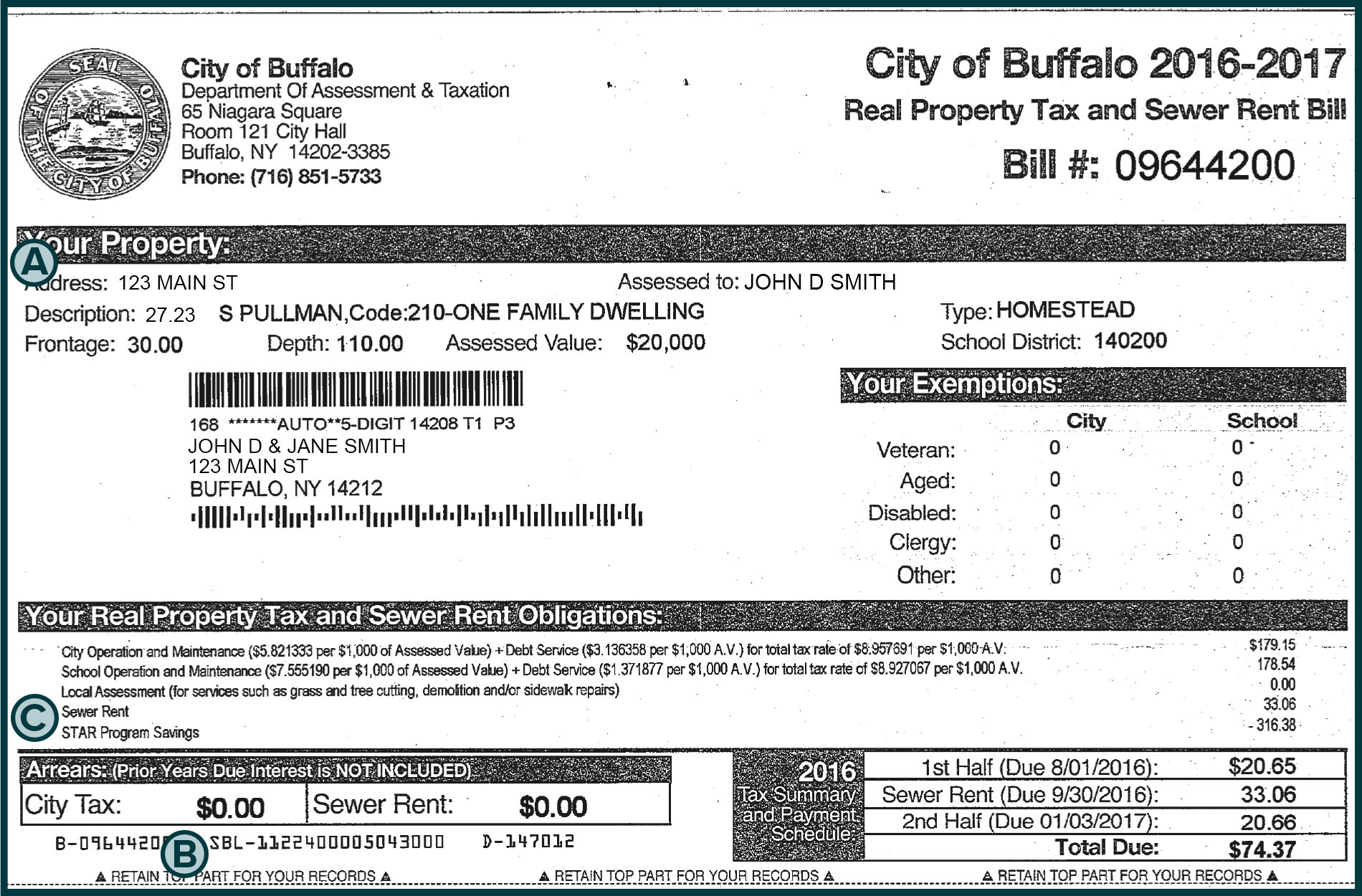

Buffalo

Section A: This is the physical address of your property.

Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term. Enter it exactly as written, including periods and hyphens.

Section C: This section indicates whether there is a STAR exemption on your tax bill and provides the dollar amount. You are not eligible for the STAR credit in any year you receive a STAR exemption.

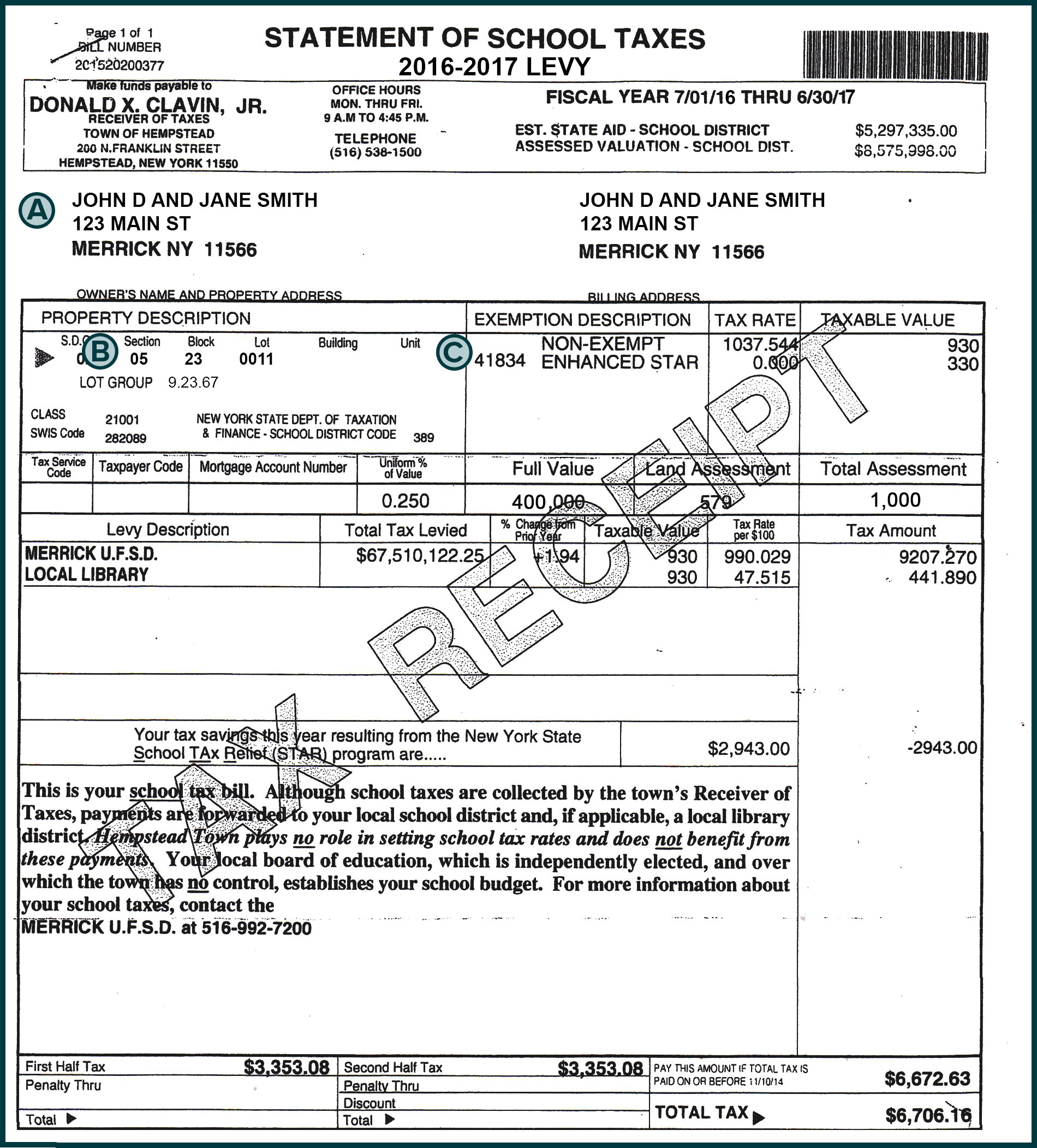

Nassau County

Section A: This is the physical address of your property.

Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term. Enter it exactly as written, including periods and hyphens.

Section C: This section indicates whether there is a STAR exemption on your tax bill and provides the dollar amount. You are not eligible for the STAR credit in any year you receive a STAR exemption.

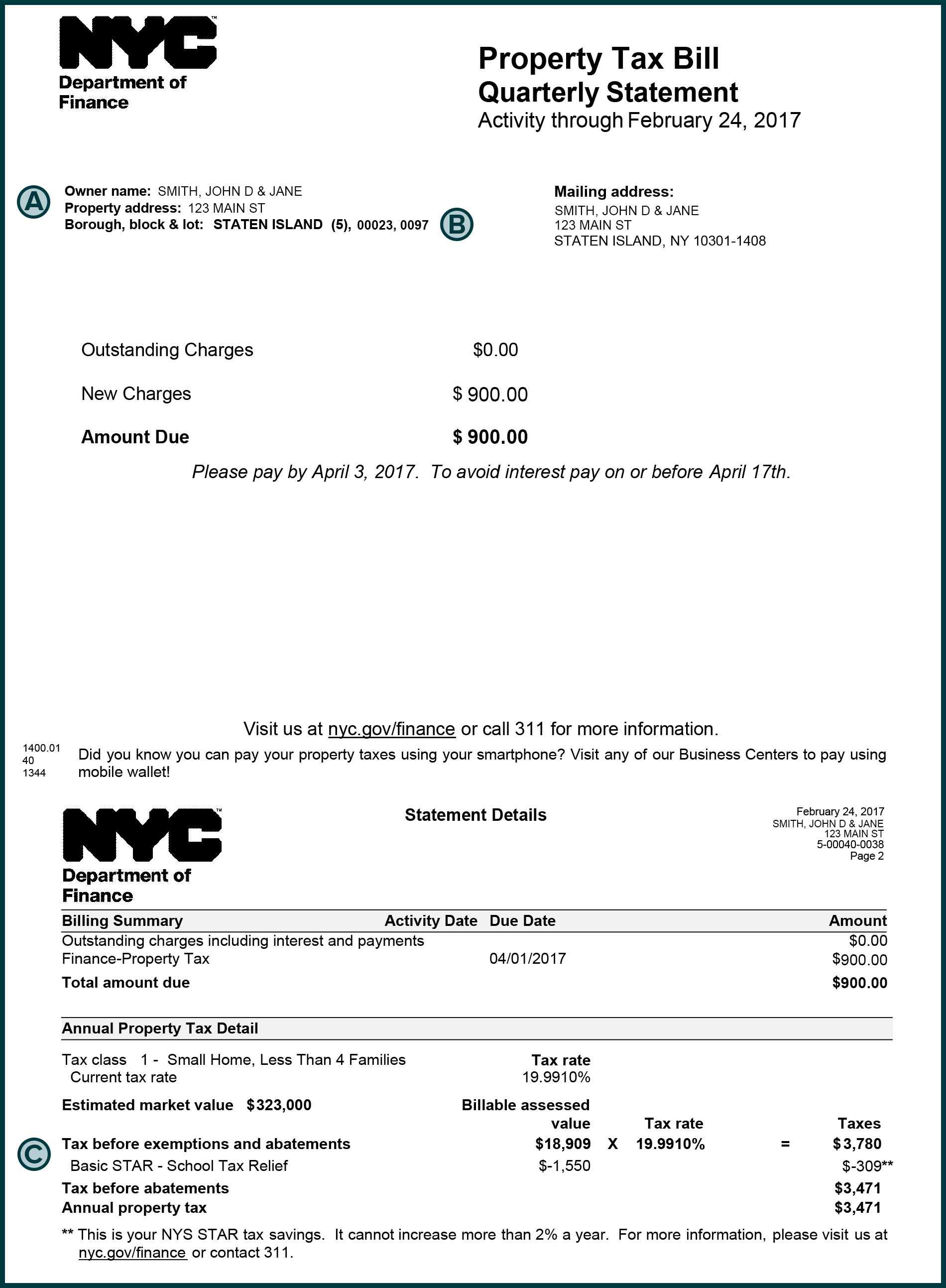

New York City

Section A: This is the physical address of your property.

Section B: This is the tax map number; also known as the borough-block-lot (BBL), print key, tax map parcel, parcel identifier, or other similar term. Enter it exactly as written, including periods and hyphens.

Section C: This section indicates whether there is a STAR exemption on your tax bill and provides the dollar amount. You are not eligible for the STAR credit in any year you receive a STAR exemption.

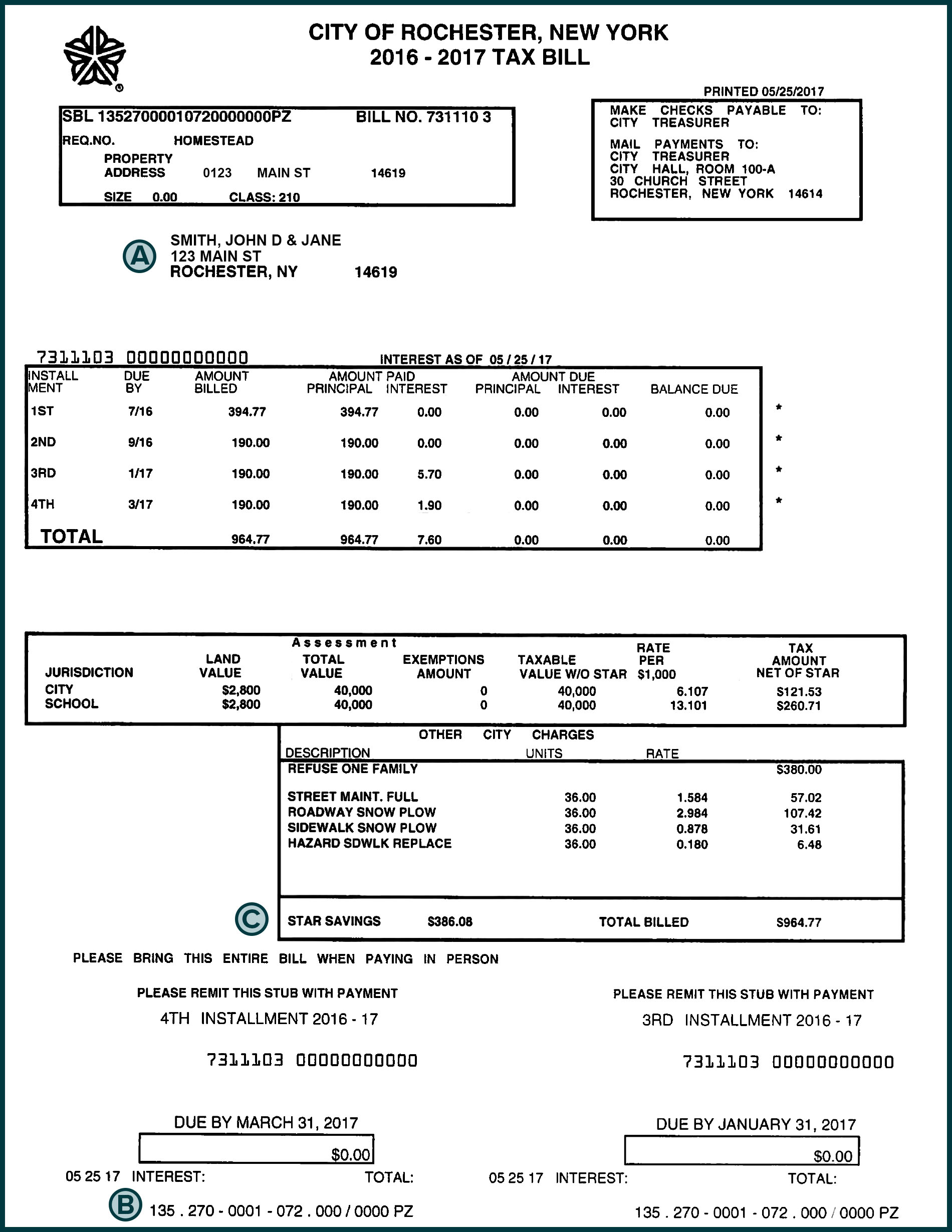

Rochester

Section A: This is the physical address of your property.

Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term. Enter it exactly as written, including periods and hyphens.

Section C: This section indicates whether there is a STAR exemption on your tax bill and provides the dollar amount. You are not eligible for the STAR credit in any year you receive a STAR exemption.

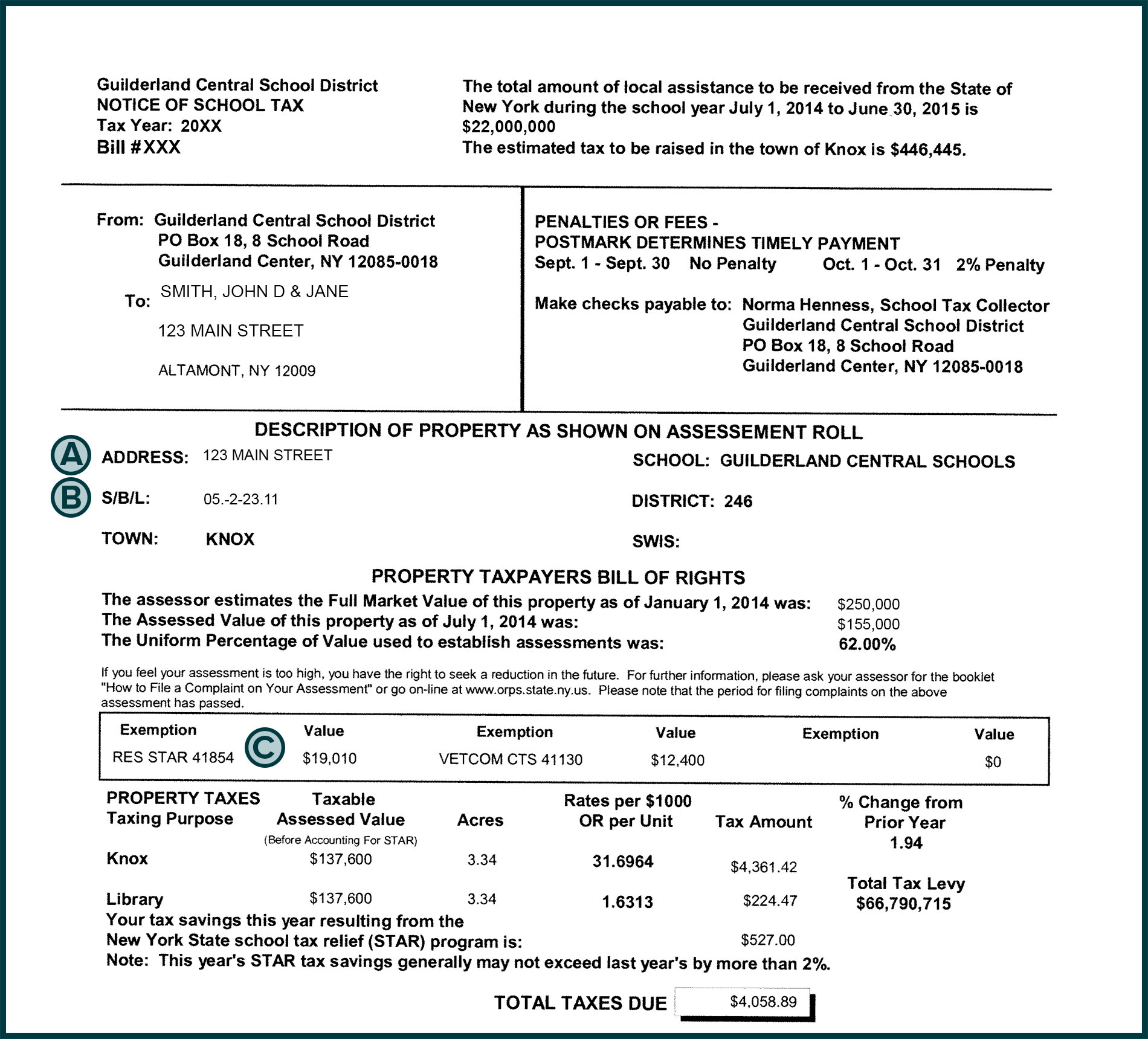

Upstate New York – Example 1

Section A: This is the physical address of your property.

Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term. Enter it exactly as written, including periods and hyphens.

Section C: This section indicates whether there is a STAR exemption on your tax bill and provides the dollar amount. You are not eligible for the STAR credit in any year you receive a STAR exemption.

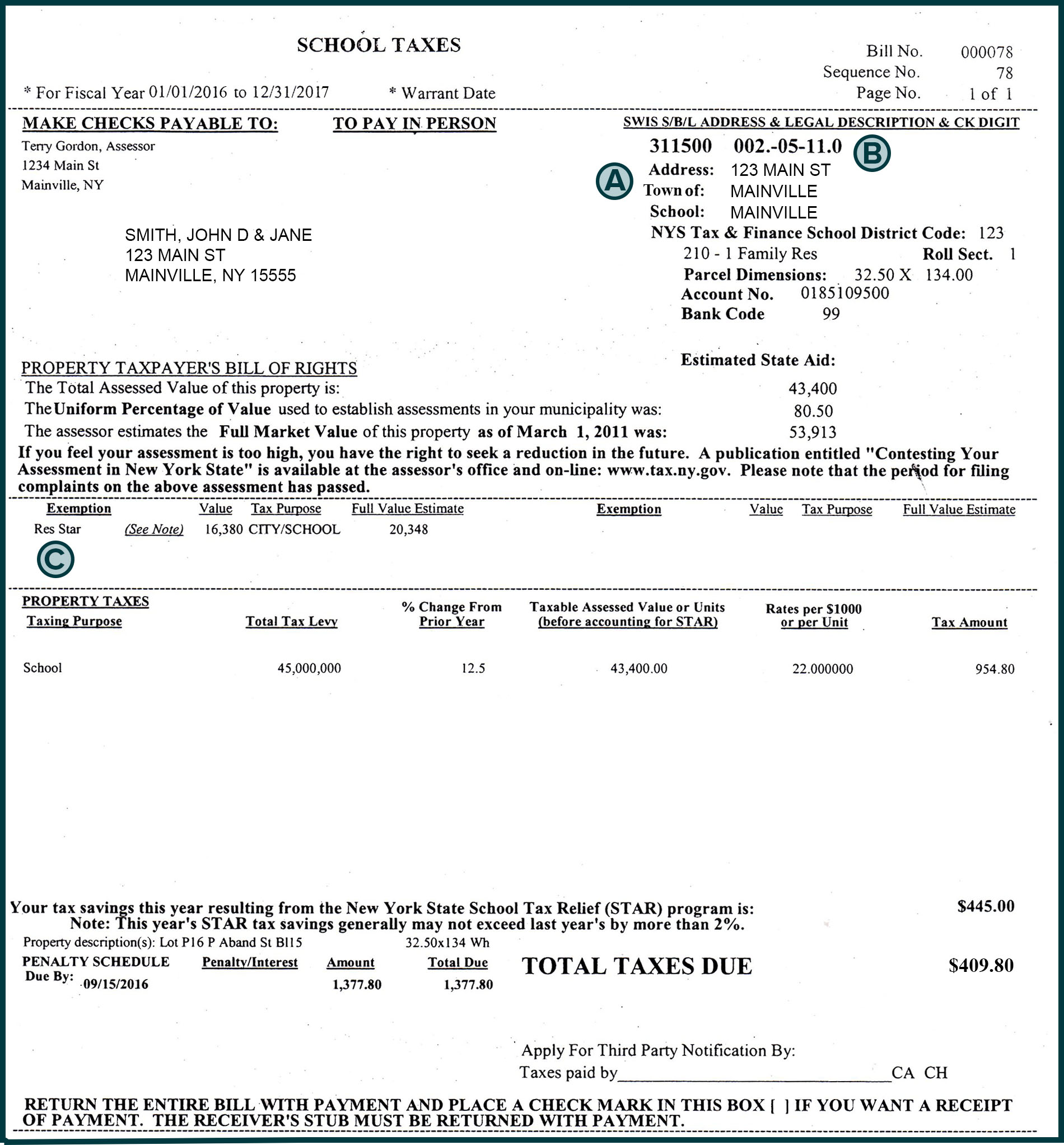

Upstate New York – Example 2

Section A: This is the physical address of your property.

Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term. Enter it exactly as written, including periods and hyphens.

Section C: This section indicates whether there is a STAR exemption on your tax bill and provides the dollar amount. You are not eligible for the STAR credit in any year you receive a STAR exemption.

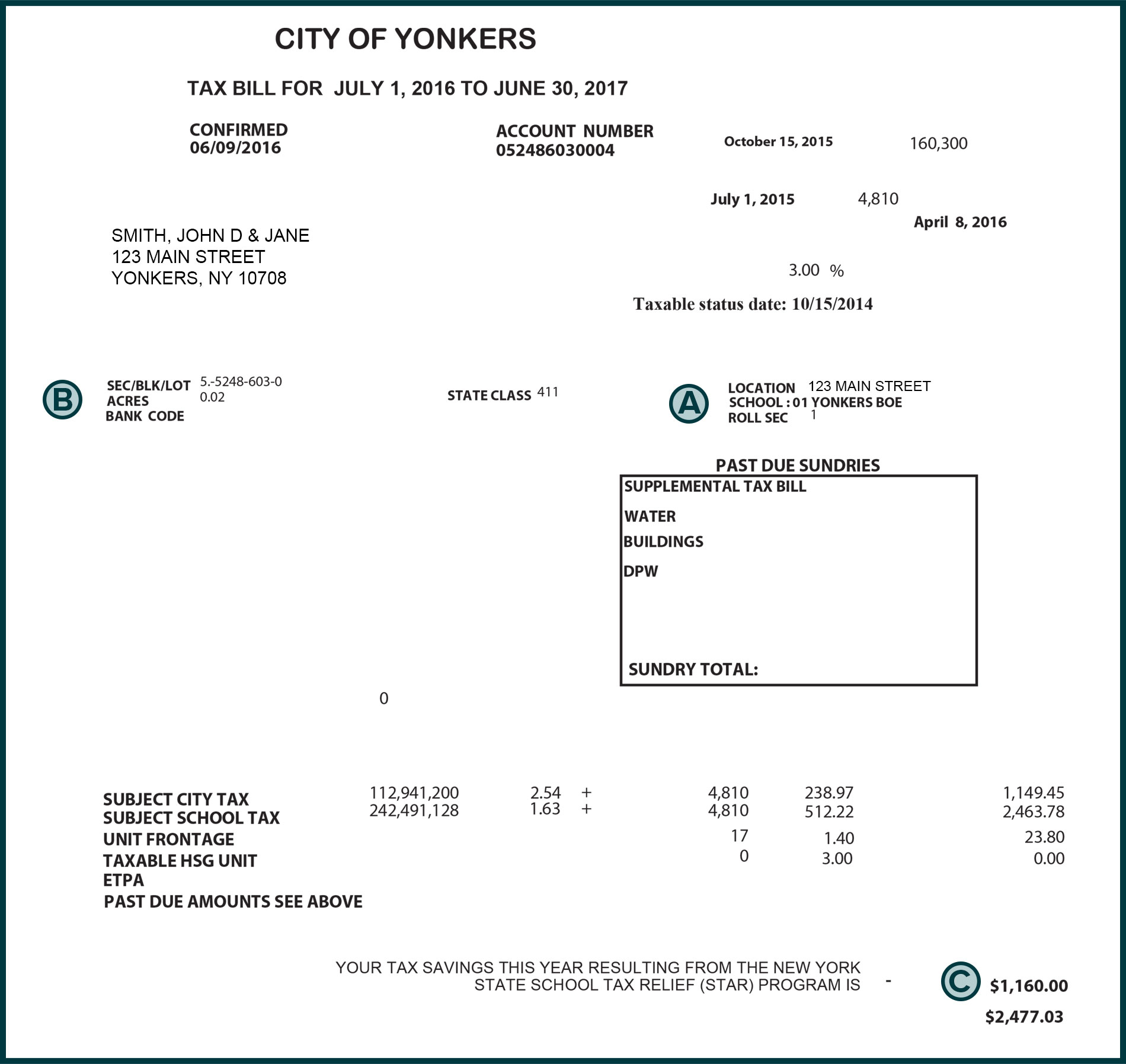

Yonkers

Section A: This is the physical address of your property.

Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term. Enter it exactly as written, including periods and hyphens.

Section C: This section indicates whether there is a STAR exemption on your tax bill and provides the dollar amount. You are not eligible for the STAR credit in any year you receive a STAR exemption.